2025 Section 179 Business Tax Savings in Waycross, GA

Section 179 Tax Deduction Updates for 2025

Small business owners in Waycross, GA, are taking notice of the latest Section 179 tax deduction updates for 2025. Robbie Roberson Ford Inc. sales experts help local contractors, fleet operators, and entrepreneurs use this cost-saving incentive to their advantage. These updates bring sharper limits, clear requirements, and time-sensitive eligibility rules, especially for qualifying work trucks, vans, and full-size commercial vehicles.

What Is Section 179?

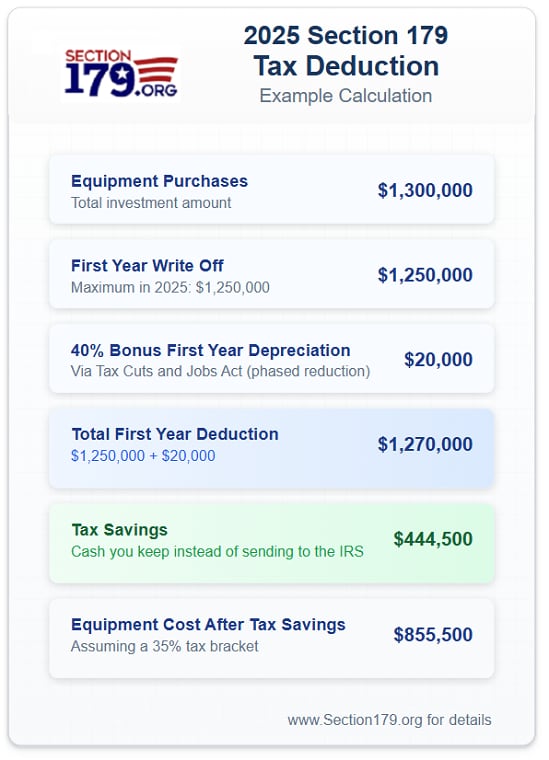

The IRS tax code's Section 179 lets you take a business deduction for the full price of qualifying vehicle or equipment purchases. Instead of writing off the vehicle's depreciation over multiple years, Section 179 allows buyers to write off the entire cost in the year the equipment is put into service. For 2025, the maximum deduction is $1,220,000, with a qualifying equipment purchase limit of $3,050,000, before the deduction phases out.

How It Works

In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example). Now, while it's true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

And that's exactly what Section 179 does - it allows your business to write off the entire purchase price of qualifying equipment for the current tax year.

This has made a big difference for many companies (and the economy in general.) Businesses have used Section 179 to purchase needed equipment right now, instead of waiting. For most small businesses, the entire cost of qualifying equipment can be written-off on the 2024 tax return (up to $1,220,000).

All vehicles used for business purposes qualify for a deduction for depreciation - although most passenger vehicles are limited by a maximum 1st year depreciation deduction of $20,200 while other vehicles that by their nature are not likely to be used more than a minimal amount for business purposes, may not qualify for the full Section 179 Deduction (full policy statement available at IRS.gov). But trucks with a GVW above 6,000 are eligible for the full 100% of the purchase price deduction if they are utilized exclusively for business purposes.

Note: The deduction for business vehicles is the same whether they are purchased outright, leased, or financed.

Limits

General Limits

Section 179 does come with limits - there are caps to the total amount written off ($1,220,000 for 2024 ), and limits to the total amount of the equipment purchased ($3,050,000 in 2024 ). The deduction begins to phase out on a dollar-for-dollar basis after this limit is reached by a given business (thus, the entire deduction goes away once $4,270,000 in purchases is reached), so this makes it a true small and medium-sized business deduction.

Limits for SUVs or Crossover Vehicles with GVW above 6,000 pounds

Certain vehicles like SUV's and Crossovers (with a gross vehicle weight rating above 6,000 lbs. but no more than 14,000 lbs.) may qualify for Section 179 or Section 168(k) "Bonus Depreciation" allowing for a business to deduct up to 100% of the purchase price in the current tax year provided the vehicle is purchased and placed in service prior to January 1, 2024, and it meets other conditions.

Who Qualifies for Section 179?

All businesses that purchase, finance, and/or lease new or used business equipment during tax year 2024 should qualify for the Section 179 Deduction (assuming they spend less than $4,270,000). Most tangible goods used by American businesses, including "off-the-shelf" software and business-use vehicles (restrictions apply) qualify for the Section 179 Deduction.

For basic guidelines on what property is covered under the Section 179 tax code, please refer to list of Section 179 Qualifying Equipment. Also, to qualify for the Section 179 Deduction, the equipment and/or software purchased or financed must be placed into service between January 1, 2024 and December 31, 2024.

For 2024, $1,220,000 of assets can be expensed; that amount phases out dollar for dollar when $3,050,000 of qualified assets are placed in service.

Which Ford Vehicles Qualify for the Deduction?

Section 179 doesn't apply to every vehicle. The IRS requires that they're used at least 50 percent of the time for business use to qualify. Passenger cars frequently have lower deduction limits unless used strictly for commercial purposes. Heavier vehicles-like the Ford F-250 Super Duty, chassis cabs, and cargo vans-typically qualify due to their weight and work-focused design. Construction, farming, and delivery businesses throughout Baxley rely on these for work and to take full advantage of the deduction before tax season closes.

Usage Requirements

You must purchase a qualified vehicle and put it into use for business no later than December 31, 2025, so a delayed delivery or registration could affect eligibility. Accurate records matter. Keep detailed logs showing how the vehicle is used for business-especially if it serves both personal and professional roles, like making sales visits or traveling to job sites around Blackshear.

Speak With Section 179 Experts in Waycross

Serving drivers from Folkston to Waycross, GA, Robbie Roberson Ford Inc. stays on top of Section 179 updates, providing easy-to-understand answers without sales pressure. Our sales and finance teams can explain how the deduction applies to your business vehicle purchase, from upfitted fleet units to work-ready pickups, helping you evaluate model weights, usage percentages, and purchase timelines. Customers near Homerville can take advantage of the deduction during the fourth quarter, when inventory levels rise and deadlines loom.

How can we help?

* Indicates a required field

-

Robbie Roberson Ford Inc.

2825 Memorial Dr.

Waycross, GA 31503

- Sales: (912) 283-3131